adversiment

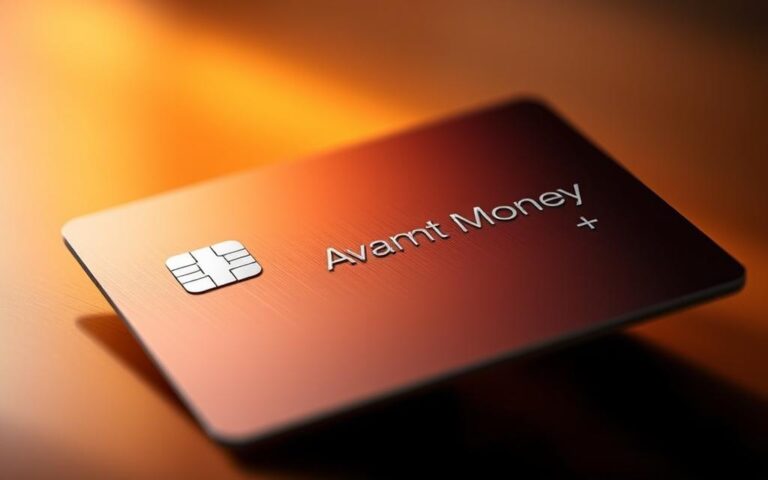

Over 60% of Irish adults seek credit card rewards with tangible financial benefits. The Avant Money Reward+ Credit Card offers a compelling solution for savvy consumers.

This guide simplifies the application process for the Avant Money Reward+ Credit Card. It’s designed for Irish residents, offering financial flexibility and substantial benefits.

The Avant Money Reward+ Credit Card is a strategic financial tool for various earners. It offers a straightforward application process that rewards smart spending and provides financial protection.

We’ll guide you through requirements, application steps, and key considerations. Our expert insights and practical advice will help you secure your new credit card.

The Avant Money Reward+ Credit Card combines rewards, security, and convenience. It stands out in the competitive Irish financial marketplace.

Get ready to unlock a world of potential financial advantages with this credit card.

Understanding the Avant Money Reward+ Credit Card Benefits

The Avant Money Reward+ Credit Card is a top-tier rewards credit card in the UK. It offers substantial cashback advantages and maximises spending potential. This card is a robust financial tool for savvy consumers.

Premium Cashback Rewards Structure

The card’s strategic rewards programme unlocks impressive credit card bonuses. It offers competitive cashback rates on everyday purchases. Higher returns are available in specific spending categories.

Cardholders can also earn bonus points for initial spending milestones. This structure ensures maximum benefits for users.

- Competitive cashback rates on everyday purchases

- Higher percentage returns in specific spending categories

- Bonus points for initial spending milestones

Travel Insurance and Purchase Protection

This card stands out with its comprehensive protection features. Travellers will appreciate built-in travel insurance for peace of mind on their journeys.

- Trip cancellation protection

- Emergency medical assistance

- Lost luggage compensation

Annual Fee and Interest Rate Details

The Avant Money Reward+ Credit Card prioritises transparency in its financial details. It offers a competitively priced annual fee. The interest rates are in line with current market standards.

Potential cardholders should review these key financial aspects:

- Competitive annual fee structure

- Transparent interest rate calculation

- Flexible repayment options

Essential Eligibility Requirements for Irish Residents

Avant money credit cards have specific eligibility criteria for Irish residents. These requirements are vital for those seeking the Avant Money Reward+ Credit Card.

The main eligibility requirements are:

- Age Requirement: Applicants must be at least 18 years old

- Residency Status: Must be a permanent resident of the Republic of Ireland

- Income Verification: Demonstrate a stable and regular income source

- Credit History: Possess a good credit rating with no significant financial defaults

Avant money credit cards suit responsible financial consumers. Potential applicants should assess their finances before applying. The card issuer will review personal and financial information thoroughly.

Your financial profile plays a critical role in the approval process for Avant Money Reward+ Credit Card.

Those meeting these criteria can apply with confidence. They have a strong chance of approval.

Clear financial records and steady income boost the odds of getting the card. These factors greatly improve your chances of success.

Avant Money Reward+ Credit Card Application Process

Applying for the Avant Money Reward+ credit card needn’t be tricky. This guide breaks down each step for Irish applicants looking for top-notch credit card deals.

Proper preparation makes the application process smoother. Having the right paperwork ready is key to a hassle-free experience with Avant Money’s Reward+ card.

Required Documentation

To ace your credit card application, gather these key documents:

- Valid photo identification (passport or driving licence)

- Proof of address (recent utility bill or bank statement)

- Proof of income (recent payslips or employment verification)

Online Application Portal Navigation

Avant Money’s online portal makes applying for the Reward+ card a breeze. Follow these smart steps:

- Create a secure personal account

- Input personal and financial information carefully

- Upload required documentation

- Review all entered details thoroughly

Identity Verification Steps

Avant Money takes your identity security seriously. Their verification process includes:

- Digital document scanning

- Cross-referencing personal information

- Optional video verification

Pro tip: Ensure all documents are clear, legible, and current to expedite your application.

Income Requirements and Credit Score Considerations

Securing the Avant Money Reward+ credit card requires solid financial preparation. Applicants must show a stable income and robust credit history. These factors are crucial for qualifying for attractive credit card rewards.

Avant Money scrutinises several key financial aspects when reviewing applications. These include minimum annual income, consistent employment, and credit score performance.

Your credit score is vital for eligibility for 0% interest cards. A strong rating can unlock premium rewards and better interest rates. Aim for a credit score above 650 to boost your approval chances.

To enhance your credit score before applying, try these steps:

- Check your credit report for accuracy

- Reduce existing credit card balances

- Ensure timely bill payments

- Avoid multiple credit applications

Pro tip: Irish financial institutions typically require consistent income and a clean credit history.

Your financial health is the key to unlocking premium credit card rewards and benefits.

Application Processing Timeline and Status Tracking

Applying for Avant money credit cards is straightforward. The process for travel rewards credit cards is efficient and transparent.

Most decisions are reached quickly. Here’s a typical timeline for applicants:

- Initial application review: 1-2 working days

- Complete assessment: 3-5 working days

- Potential additional information request: Up to 7 working days

Decision Timeline Expectations

Avant Money aims for swift application processing. Most decisions are sent within 3-5 working days. Applicants receive digital notifications via email or mobile.

Additional Information Requests

Sometimes, the credit team needs more documents. These requests are simple and may include:

- Proof of income

- Identification verification

- Address confirmation documents

Card Delivery Process

After approval, card delivery is smooth. New travel rewards credit cards arrive within 5-7 working days of approval.

| Stage | Typical Duration |

|---|---|

| Application Submission | Immediate |

| Initial Review | 1-2 Working Days |

| Final Decision | 3-5 Working Days |

| Card Delivery | 5-7 Working Days |

Pro tip: Stay alert and respond quickly to requests. This can speed up your Avant Money credit card application.

Managing Your Application Success Rate

Applying for the Avant Money Reward+ credit card requires careful planning. To boost your chances of approval, take a proactive approach. Review your financial profile thoroughly before submitting your application.

Here are key steps to improve your success rate:

- Obtain a free credit report from Irish credit bureaus

- Check for any inaccuracies or outdated information

- Resolve any outstanding credit issues

- Ensure all personal documentation is current and precise

Financial preparation is crucial for credit card rewards applications. Lenders assess multiple factors beyond simple credit scores. Consider these strategic recommendations:

- Maintain a stable employment history

- Demonstrate consistent income

- Minimise existing credit card balances

- Avoid multiple credit applications within short periods

Don’t be discouraged if your initial application is unsuccessful. Ask the lender for specific feedback to understand areas for improvement. Each application provides valuable insights for future financial planning.

Pro tip: Timing your credit card rewards application can significantly impact your approval likelihood.

By following these strategies, you’ll improve your chances of getting the Avant Money Reward+ credit card. This can help you access attractive financial benefits.

Conclusion

The Avant Money Reward+ credit card application process is straightforward when you know the steps. This cashback card offers Irish residents a chance to earn rewards whilst managing their finances.

The application involves preparation, meeting eligibility criteria, and providing accurate documentation. Focus on your credit score and income requirements to boost your chances of success.

Review the details in previous sections to ensure you meet all conditions. The card’s cashback rewards and financial protections make it an attractive choice in the Irish market.

With proper preparation, eligible Irish residents can confidently apply for this valuable financial tool. The Avant Money Reward+ credit card could be a great addition to your financial portfolio.