adversiment

In 2024, 40% of Australians under 35 still live with parents. This shows how tough home affordability is in Australia. The rent vs buy choice is more complex than ever before.

The housing market needs smart thinking and deep knowledge. Buying a first home or looking at long-term investments both need careful thought.

Let’s look at what affects housing choices in 2025. We’ll explore economic trends and personal money matters.

Current market trends and your financial health are key. These factors help decide if renting or buying suits your lifestyle and money goals.

Understanding the Current Housing Market in Australia

The Australian residential real estate market in 2025 offers both opportunities and challenges for property investors. To succeed, you’ll need to grasp current market trends, regional differences, and economic factors.

This dynamic environment requires careful navigation and informed decision-making. Understanding the nuances of each region can help you make smart investment choices.

Recent data shows significant changes in Australia’s housing landscape. Investors and potential homeowners face a market with diverse regional performances.

Economic conditions are evolving, creating a complex scenario for property investment. Staying informed about these shifts is crucial for success.

Price Trends Across Major Markets

The residential real estate market varies across different Australian regions:

- Sydney continues to maintain high property values

- Melbourne experiences moderate price stabilization

- Brisbane demonstrates emerging investment potential

- Regional areas show unexpected growth patterns

Demand and Supply Dynamics

Property investment strategies must consider critical market factors:

| Market Factor | Impact on Housing |

|---|---|

| Population Growth | Increasing urban housing demand |

| Immigration Policies | Potential expansion of rental markets |

| New Housing Developments | Balanced supply in metropolitan areas |

Regional Market Variations

The Australian housing landscape differs across regions. Urban centres and regional markets offer unique investment opportunities.

These differences challenge traditional views about the residential real estate market. Recognising these variations can lead to more successful investments.

“Understanding regional nuances is key to successful property investment in 2025″ – Australian Property Insights Report

Economic Factors Influencing Rent vs Buy Decisions

The Australian housing market is shaped by complex economic factors. These factors affect mortgage rates and living costs. They play a crucial role in deciding whether to rent or buy.

Property seekers face a tricky decision-making process. Several key elements need careful thought when choosing housing options.

Interest Rates and Their Impact

Mortgage rates are vital in determining housing affordability. Recent trends show fluctuating interest rates. These directly influence how much people can borrow.

- Lower rates reduce borrowing costs

- Higher rates increase monthly repayment burdens

- Variable rates offer flexibility but potential uncertainty

Inflation Effects on Housing Costs

Inflation is a constant challenge in the Australian housing market. It affects both renters and potential buyers. Living costs keep rising, putting pressure on housing expenses.

| Economic Indicator | Impact on Housing | Potential Strategy |

|---|---|---|

| Inflation Rate | Increases property values | Consider long-term investment |

| Rental Prices | Rises with living costs | Evaluate buying vs ongoing rent |

| Construction Costs | Impacts new property prices | Assess market timing |

Government Incentives for Buyers

Government programs can help reduce housing costs. Key incentives include:

- First Home Owner Grants

- Stamp duty concessions

- Affordable housing schemes

Potential buyers should keep track of government support programs. These could make owning a home more achievable.

Pros and Cons of Renting a Home

Renting in Australia offers both opportunities and challenges for potential tenants. Understanding these can help people make smart financial decisions that match their lifestyle goals.

The rental market has many factors to consider. These impact both short-term ease and long-term money plans.

Flexibility and Mobility

Renting gives Aussies great flexibility in their living choices. It allows easy moves for job chances and no long-term upkeep duties.

You can also change suburbs without big money penalties. This freedom is a key perk of renting.

- Easy relocation for career opportunities

- No long-term property maintenance commitments

- Ability to change neighborhoods without significant financial penalties

Financial Considerations

Renting can make money planning more flexible. Renters might save cash for diverse investments and avoid big property buy costs.

They can also keep more ready cash. This can be helpful for other financial goals.

- Invest saved capital in diversified investment portfolios

- Avoid substantial upfront property purchase costs

- Maintain greater financial liquidity

“Renting provides financial breathing room for strategic investment and personal growth” – Australian Property Insights

Maintenance Responsibilities

Rental deals often shift upkeep tasks away from tenants. This setup offers less personal repair costs and steady monthly housing expenses.

You also get pro property management help. This can make life easier for renters.

- Reduced personal repair expenses

- Predictable monthly housing costs

- Professional property management support

Renting has clear perks, but everyone’s needs are different. It’s crucial to weigh your own situation when choosing a housing plan.

Advantages of Buying a Home

Buying a home is a big step in an Aussie’s financial life. It offers great chances to build wealth. This goes beyond just having a place to live.

Owning property can be a smart way to invest. The potential for long-term growth makes it appealing.

Long-Term Investment Benefits

Property in Australia has shown strong returns over time. Homeowners can benefit from rising property values. This allows people to build wealth as time goes on.

Real estate often increases in value. This gives investors a solid financial asset to hold onto.

- Potential for property value appreciation

- Opportunity to generate rental income

- Tax advantages for property owners

Building Equity Over Time

Paying off a mortgage helps create wealth. Each payment reduces the principal balance. This lets homeowners build up a valuable asset.

Over time, this equity growth provides financial security. It can also give you options for borrowing in the future.

Security and Stability

Owning a home offers more than just money benefits. It gives a sense of stability and permanence. Homeowners can make their space truly their own.

You can build strong ties in your community. There’s also a great feeling of personal achievement in owning a home.

“Homeownership is not just about owning property, but about creating a foundation for long-term financial success.” – Australian Real Estate Institute

The Role of Home Loan Products

Buying a home in Australia can be tricky. It’s vital to grasp mortgage rates and affordability when looking at loan options in 2025. Choosing wisely can turn a financial burden into a smart investment.

Australian lenders offer many home loan products. These cater to different financial needs. Buyers can pick from various loan types that shape their long-term money plans.

Types of Home Loans

- Principal and Interest Loans

- Interest-Only Loans

- Investment Property Loans

- Low Deposit Loans

Fixed vs Variable Rates

Mortgage rates greatly affect home affordability. Borrowers should weigh up fixed and variable rate loans carefully.

| Fixed Rate Loans | Variable Rate Loans |

|---|---|

| Predictable repayments | Potential for lower initial rates |

| Protection against rate increases | Flexibility to benefit from market changes |

First-Time Buyer Programs

Several schemes help first-time homebuyers improve affordability:

- First Home Guarantee Scheme

- First Home Super Saver Scheme

- State-based first homeowner grants

Careful research and professional financial advice can help buyers select the most suitable home loan product for their unique circumstances.

Renting vs Buying: Cost Analysis

The rent vs buy decision in Australia requires a deep look at finances. Housing costs greatly affect choices for potential homeowners and renters. A detailed cost analysis is key to making the right choice.

Comparing renting and buying reveals key factors that shape long-term finances. These factors can greatly impact your financial future.

Upfront Costs: A Detailed Breakdown

- Buying a home involves substantial initial expenses:

- Deposit (typically 10-20% of property value)

- Stamp duty

- Legal fees

- Building inspection costs

- Renting requires minimal upfront investment:

- Bond (usually 4-6 weeks’ rent)

- First month’s rent in advance

- Minimal administrative fees

Monthly Payment Comparison

Rent vs buy costs vary widely across Australia. Here’s a look at monthly expenses in different cities:

| City | Average Monthly Rent | Average Monthly Mortgage |

|---|---|---|

| Sydney | $3,200 | $3,800 |

| Melbourne | $2,800 | $3,500 |

| Brisbane | $2,500 | $3,200 |

Hidden Costs of Homeownership

Many buyers forget about the additional expenses of owning property. These costs can add up quickly.

- Council rates

- Home insurance

- Maintenance and repairs

- Strata fees (for apartments)

- Property management costs

Knowing these financial details is crucial for making smart choices. It helps you decide whether to rent or buy in Australia’s property market.

Regional Considerations: Where to Rent or Buy

Australia’s property market offers diverse investment opportunities across regions. Each location has unique features that can affect your housing choices. Understanding these differences is key to making smart decisions.

Regional markets have their own challenges and potential. Careful analysis is crucial for both renters and buyers. Each area offers distinct opportunities worth exploring.

Major Cities: Sydney, Melbourne, Brisbane

Australia’s major cities show significant differences in their property markets:

- Sydney continues to be a premium property investment destination with high-value real estate

- Melbourne offers diverse suburban opportunities with strong rental markets

- Brisbane presents more affordable entry points for property investors

Regional Areas: Prospects for Growth

Investors are showing more interest in emerging regional markets. Some areas are experiencing infrastructure growth and changing work patterns. These changes create exciting new opportunities.

- Coastal regions with remote work potential

- Agricultural and mining towns undergoing economic transformation

- Satellite cities with improved transportation links

Local Rental Markets vs Property Prices

Comparing rental and purchase options reveals valuable insights. Local market conditions can dramatically influence investment decisions. These factors are crucial when choosing between renting and buying.

Understanding regional variations is crucial for making informed property investment choices.

Successful property investment requires thorough research. Look into local market trends, economic indicators, and growth potential. This approach helps make informed decisions across different Australian regions.

Lifestyle Considerations in the Rent vs Buy Debate

Your lifestyle shapes your housing choice. Renting and buying each have unique perks. These can affect your daily life and future plans.

Personal preferences and long-term goals matter too. They’re key in this big decision.

Family Needs and Space Requirements

Owning a home can be great for families. It offers stable environments and customizable spaces. These adapt to changing family needs.

Renting has its own perks. It provides flexibility for growing or changing families.

- Families with children may prefer:

- Larger living spaces

- Potential for home modifications

- Stable neighborhood environments

- Renters might prioritize:

- Shorter-term commitments

- Easier relocation options

- Less maintenance responsibility

Urban vs Suburban Living Preferences

Your lifestyle affects your ideal housing choice. Urban dwellers might prefer renting. It offers closeness to work and lively social scenes.

Suburban residents often like owning homes. They enjoy more privacy and community connections.

| Living Preference | Renting Characteristics | Buying Characteristics |

|---|---|---|

| Urban Living | Flexible location | Limited property customization |

| Suburban Living | Limited community engagement | Long-term community roots |

Community and Social Factors

Social ties influence housing decisions. Homeownership benefits often include deeper community bonds. Renting advantages offer more social flexibility.

“Your home is more than a physical space—it’s a reflection of your lifestyle and personal journey.” – Australian Housing Insights

Knowing these lifestyle factors helps you make smart housing choices. They can align with your personal goals and dreams.

Future Trends: Predictions for the Australian Housing Market

Major changes are coming to Australia’s housing market. New tech, changing demographics, and possible policy shifts will affect how we live and plan financially.

Tech is changing how we deal with property. Virtual tours and digital platforms are getting better. They’re making it easier for people to buy and rent homes.

Impact of Technology on Real Estate

- Advanced virtual reality property inspection technologies

- Blockchain-enabled secure property transactions

- Smart home integration and IoT developments

- AI-powered property valuation tools

Potential Policy Changes

The government might change some rules about housing. These changes could affect taxes and incentives for home buyers. This could really shake up the property market.

| Policy Area | Potential Impact |

|---|---|

| Negative Gearing | Potential restrictions on investment property tax deductions |

| First Home Buyer Schemes | Enhanced government support for new homeowners |

| Capital Gains Tax | Possible modifications to property investment incentives |

Demographic Shifts in Housing

Young buyers are changing what people want in homes. They like shared housing and spaces for working from home. They also care about living in eco-friendly places.

- Growing preference for urban-centric, smaller living spaces

- Increased demand for technology-enabled homes

- Emphasis on sustainability and energy efficiency

The housing market is always changing. Buyers, sellers, and investors will need to keep up. Being flexible will be key in this new landscape.

Making the Right Decision: Key Takeaways

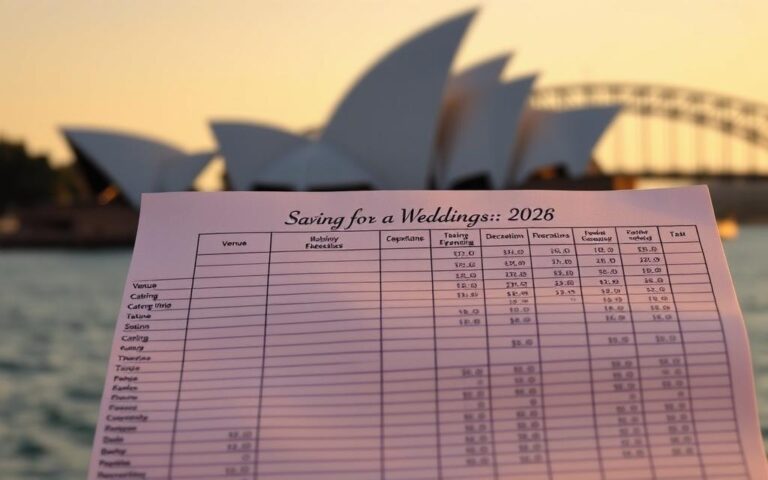

The Australian property market needs careful planning and smart thinking. Your rent vs buy choice depends on your situation, money, and long-term housing goals.

Good money planning means looking at your current financial state. Think about your job security, saving ability, and future career path. This will help you decide if buying or renting suits you better.

Personal Financial Assessment

Experts suggest doing a detailed money check before making big property choices. Work out how much you can borrow and what your mortgage payments might be. Compare these to your current rent costs.

Don’t forget extra costs like stamp duty and upkeep. Also, think about how property values might change in your area.

Consulting with Real Estate Professionals

Getting advice from experienced mortgage brokers and property advisors can be very helpful. They can explain tricky parts of the Australian housing market. These experts give personal advice based on your money situation.

Long-Term Goals and Housing Needs

Your housing plan should match your life goals. You might want to invest, have a stable family home, or keep your options open. Remember, the right choice is different for everyone in Australia’s varied property market.

FAQ

Is buying a home always better than renting in Australia?

Buying or renting depends on personal and financial factors. These include your financial situation, goals, and local property market conditions. Both options have pros and cons that need careful thought.

How much deposit do I need to buy a home in Australia?

Most lenders require a 20% deposit to avoid Lenders Mortgage Insurance (LMI). Some first-home buyer programs allow deposits as low as 5-10%. These often come with extra costs and conditions.

What are the hidden costs of buying a home?

Home buyers should budget for more than just the purchase price. Extra costs include stamp duty, legal fees, and building inspections. Home insurance, council rates, and maintenance costs also add up.

These additional expenses can greatly impact the overall cost of owning a home.

How do current interest rates affect the rent vs buy decision?

Interest rates directly impact mortgage affordability and monthly repayments. Lower rates can make buying more attractive. However, rates are just one factor to consider alongside property prices.

Personal financial circumstances and long-term investment potential are also important.

What government incentives are available for first-home buyers in Australia?

Several government incentives exist for first-time buyers. These include the First Home Owner Grant (FHOG) and First Home Loan Deposit Scheme. Stamp duty concessions are also available in some states.

These programs can provide significant financial help to first-time buyers.

Is it better to buy in a city or a regional area?

The choice depends on job opportunities, lifestyle preferences, and property prices. Cities often offer more job markets and amenities. Regional areas might provide more affordable properties and potential for future growth.

How long should I plan to stay in a property to make buying worthwhile?

Financial experts suggest staying in a property for at least 5-7 years. This timeframe helps offset initial purchase costs and market fluctuations. It also allows you to build equity and benefit from property value appreciation.

What are the advantages of renting in the current Australian market?

Renting offers flexibility, lower upfront costs, and fewer maintenance responsibilities. It allows easier relocation and frees up capital for other investments. Renting can provide more short-term financial flexibility compared to homeownership.

How do I know if I’m financially ready to buy a home?

Consider factors like stable income, good credit history, and sufficient savings. Manageable debt levels and clear long-term financial goals are also important. Consulting a financial advisor can help assess your readiness.

What impact does inflation have on the rent vs buy decision?

Inflation can benefit homeowners as property values and rental prices typically increase. Fixed-rate mortgages may become relatively cheaper over time. Renters might face increasing costs that outpace their income growth.